The way financial support works to help low income households with Council Tax will change from 1 April, after revisions to Council Tax Reduction were agreed at last Thursday's council meeting (Feb 3).

Council Tax Reduction (CTR) helps low income households with their Council Tax.

Residents who pay Council Tax are eligible for support if their income and savings are below a certain level.

The key change is to switch to a scheme based on earnings brackets for people claiming Universal Credit.

The revised scheme was agreed following consultation on the proposed changes in the autumn.

The changes only affect working age people who are claiming Universal Credit.

People of pensionable age are assessed under national rules and the way their Council Tax Reduction will be worked out will not change.

Anyone not currently claiming Universal Credit will stay on the existing CTR scheme.

There are currently around 12,300 working age households in the city claiming CTR.

How the new scheme will work

In the new scheme for Universal Credit claimants, calculation will be based on net earnings, and seeing what bracket they fall into.

This means the amount of reduction claimants get will depend on how much they earn from working.

Their other income will be ignored, such as Universal Credit, other benefits or pensions.

People who are not working, or on the lowest earnings, will continue to have an 82% reduction to their Council Tax, while people in higher earnings brackets will pay more, depending on their weekly earnings.

The aim of this is to make the scheme easier to understand and fit better alongside Universal Credit claims, which can change monthly.

As more people move on to Universal Credit, it will remove the need to recalculate a claimant’s CTR and Council Tax bill every month – removing a lot of extra administration and making it much clearer how much they need to pay.

The other advantages of the new scheme include:

- It will be more generous to families with children, including lone parent families, and in particular low income, working households.

- More households will be entitled to it - households earning up to £250 a week will be entitled to CTR, equivalent of the 2021 minimum wage for 35 hours a week.

- Changes to CTR will only happen when a band is jumped, meaning that the amount of Council Tax left to pay will not change so frequently.

- Fewer Council Tax bills will be sent, resulting in more clarity and ability to plan household budgets. It will also mean that debt situations will be visible sooner, which in turn means that signposting and referral to support and debt advice can be provided sooner.

Increasing financial support for residents

Councillor David Gibson, joint deputy chair of the Policy & Resources Committee (Finance & Resources), said:

“One of our key priorities is to address inequality, poverty and financial inclusion in the city.

“Last year we made the scheme more generous for those on the lowest incomes. This year, we’re increasing the support which allows us to reach more people and make the scheme simpler.

“As more people move on to Universal Credit, the current scheme is proving burdensome to manage and confusing for people to know how much they need to pay.

“We’re keen to cut down the unnecessary administration and make sure we can use the ever-reducing funding we receive to financially support those who need it most.

“Since the government scrapped Council Tax Benefit in 2013 and placed the cost of supporting people with Council Tax bills on to councils, we have to strike a balance between the cost of the scheme with the council’s ever increasing budget pressures.”

Read the full details in the report to the Full Council meeting on 3 February 2022 (agenda item 66).

The new scheme for people claiming Universal Credit will be introduced from 1 April 2022.

Information provided by Brighton & Hove City Council

Brighton: A23 Improvement Work To Begin In June

Brighton: A23 Improvement Work To Begin In June

New Ancient Trade Exhibition To Open At The Beachy Head Story

New Ancient Trade Exhibition To Open At The Beachy Head Story

Sussex Beaches Win Big In Annual Awards

Sussex Beaches Win Big In Annual Awards

Police Still Searching For Two Men Over Hastings Fatal Hit-And-Run

Police Still Searching For Two Men Over Hastings Fatal Hit-And-Run

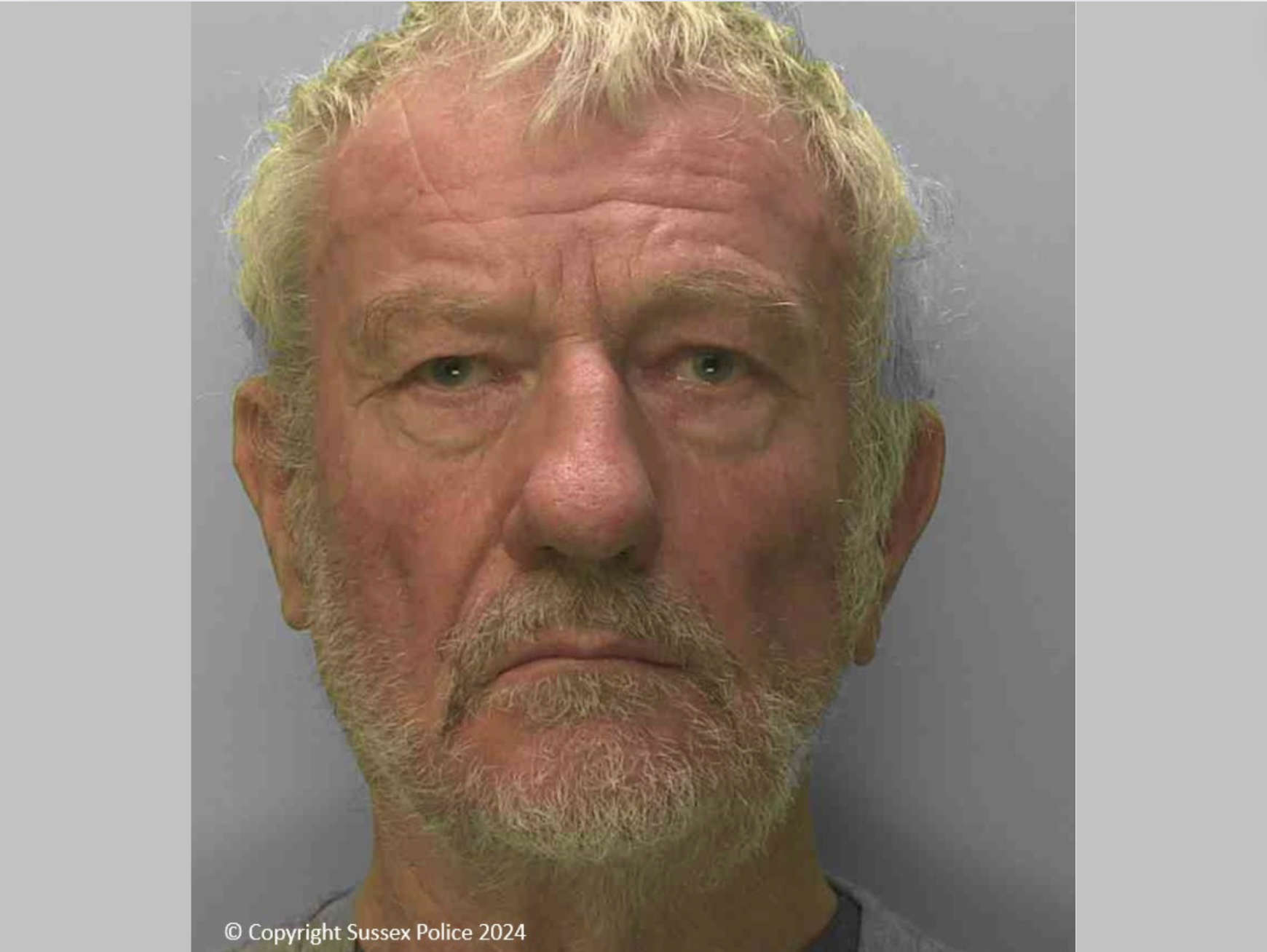

Pulborough Rapist Has Jail Sentence Extended After Appeal

Pulborough Rapist Has Jail Sentence Extended After Appeal

Planners Approve Battery Storage Facility In Hooe

Planners Approve Battery Storage Facility In Hooe

Children’s Charity Launches Campaign To Provide Wellbeing Service at Brighton Hospital.

Children’s Charity Launches Campaign To Provide Wellbeing Service at Brighton Hospital.

Sussex Air Ambulance Charity Raises £1m To Buy Its Helicopter

Sussex Air Ambulance Charity Raises £1m To Buy Its Helicopter

New Southern Timetable To Add 5,000 South Coast Seats From Next Month

New Southern Timetable To Add 5,000 South Coast Seats From Next Month

New Mayor A Leader For ‘Unity And Progress In Brighton & Hove’

New Mayor A Leader For ‘Unity And Progress In Brighton & Hove’